If you are a salaried individual and looking to optimize taxes and maximize tax exemptions and deductions on your salary, refer this ultimate guide for tax exemptions and deductions.

There are two ways to reduce tax liabilities, Exemptions and deductions.

Tax Exemptions refer to amounts of income that are not taxed at all, meaning they are completely excluded from the taxpayer’s taxable income. For example, house rent allowance.

Tax Deductions refer to expenses that can be subtracted from taxable income to reduce the tax liability. For example, Public Provident Fund (PPF), under section 80C.

Let’s learn about important exemptions and deductions.

Tax Exemptions

1) Standard Deduction: There is a standard deduction of 50,000 on your salary

2) House Rent Allowance (HRA): You need to submit rent receipts to your employer to claim HRA. The amount that can be claimed under HRA is calculate as least of

a) Total HRA received from employer

b) Total rent paid – 10% of (basic + DA)

c) 40% of (basic + DA), 50% of (basic +DA) in Mumbai, Delhi, Chennai and Kolkata

3) Leave Travel Allowance (LTA): Here an individual can claim travel expenses incurred during leaves by them.

a) It includes only travel expense incurred on air, rail, public transport

b) It convers only domestic travel and not international travel

c) It can be claimed twice in a block of 4 years

d) Family including parents & siblings are also considered

4) Employer Portion of PF contribution: Employer portion of PF contribution is exempted from tax whereas Employee portion comes under 80C

5) Below other exemptions can also be claimed if they are offered by employers

a) Mobile Reimbursement

b) Books Cost

c) Food Coupons (max 26,400 per annum)

d) Relocation Allowance

e) Children Fee Allowance (max 1,200 per annum per child)

f) Gift voucher (max 5,000 per annum)

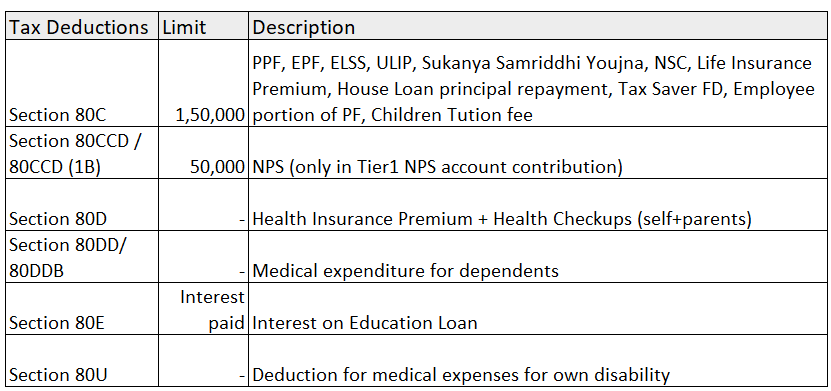

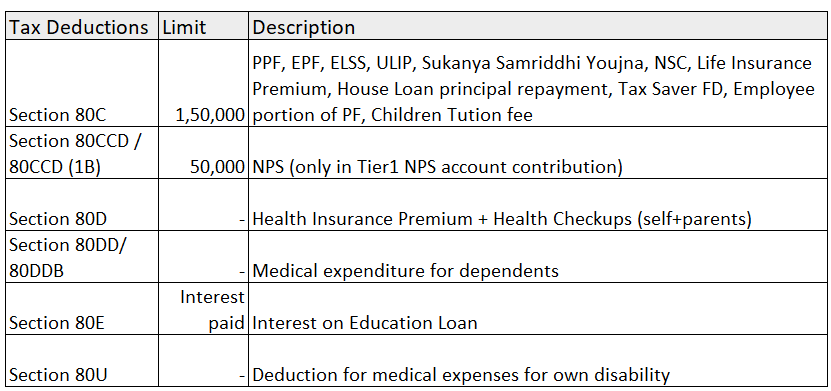

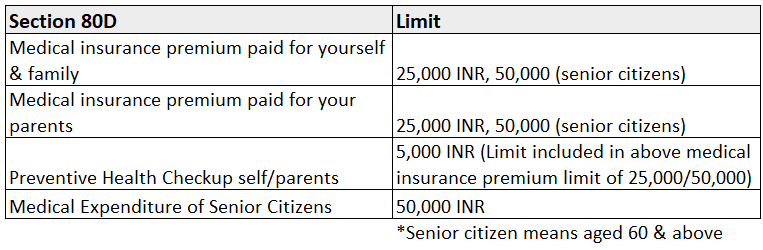

Tax Deductions

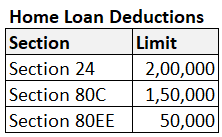

Tax Benefits on Home Loan

There are benefit on both the principal component of Home Loan and Interest component of Home loan.

Claiming Home Loan Principal Payment (Section 80C)

· It comes under 80C Limit of 1,50,000

· It can only be claimed after completion of construction

· Only loan borrowed for Purchase or construction of house is considered

· Expenses for Stamp Duty & Registration charges can also be claimed under 80C, it can be claimed in the respective year of payment of these charges

Claiming Home Loan Interest Payment (Section 24)

· You can claim tax on interest payments

· If loan is taken for construction or purchase of house, You can claim deduction upto 2,00,000

· If loan is taken for renovation, You can claim upto 30,000

· Tax benefits is claimed after completion of house. The interest levied on time period till construction to completion, can also be claimed after completion.

· For Example, if the total interest for whole pre-completion period is 30,000 Rs, property took 3 years to complete and Post Completion annual interest is 10,000 Rs

· Amount that is tax deductible is (30,000/3)+10,000 = 40,000 for first 3 years, 10,000 onwards

Additional deduction for first time home buyers (Section 80EE)

· Additional benefit of 50,000 on interest paid on home loan

· Applicable only on loans taken in FY17

· Amount of Loan shall not exceed 35 Lakhs

Additional deduction for first time home buyers (Section 80EEA)

· Additional benefit of 1,50,000 on interest paid on home loan

· Applicable only on loans taken in FY20, FY21, FY22

· Amount of Loan shall not exceed 45 Lakhs

Feel free to schedule a call with us here Consult Us , we will handhold you in optimizing your taxes and creating personalized investment plan for you.

Join our community over at Instagram and Facebook