Systematic Investment Plan (SIP) is a way of investment in which you invest some amount on a regular basis, If you are already having SIPs you must be interested in calculating your returns from investment. Let’s discuss how to calculate returns in SIP.

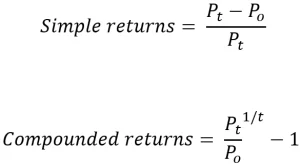

The normal simple return & compound return formula that we study in school works when you do one time investment but not in SIPs because its overlooks aspects like

- Volatility

- Irregular interval of investments

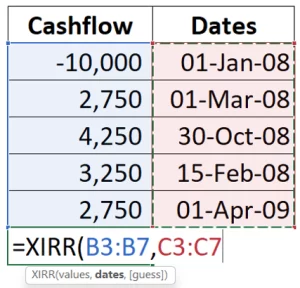

To calculate SIP returns we can use XIRR (Extended Internal Rate of Return) of excel, in backend it calculates compounded returns for all the investment amount at different time intervals.

Above example gives 60.6% annualized returns. Here based on dates and cashflows you can accurately calculate your ROI. Remember XIRR gives annualized returns, not returns for overall duration.

Reference: XIRR function – Microsoft Support

Want to get started with your Mutual Fund Investment journey?

We are a team of AMFI Registered Mutual Fund Distributors. You can Consult us, we will help you choose the right mutual funds for your portfolio based on your investment goals, risk tolerance, and other factors.