Avoid this most common mistake while investing in mutual fund . One of the most common mistakes people make while investing in mutual funds is chasing past performance and investing in funds that have recently performed well. This is known as “Recency Bias.” Many investors tend to invest in funds that have delivered high returns in the recent past, assuming that these returns will continue into the future.

Investing based solely on past returns is like driving a vehicle while looking in the rear-view mirror. Just as you need to look ahead and anticipate obstacles and changes in the road, you also need to look forward when investing and anticipate changes in the market and economy.

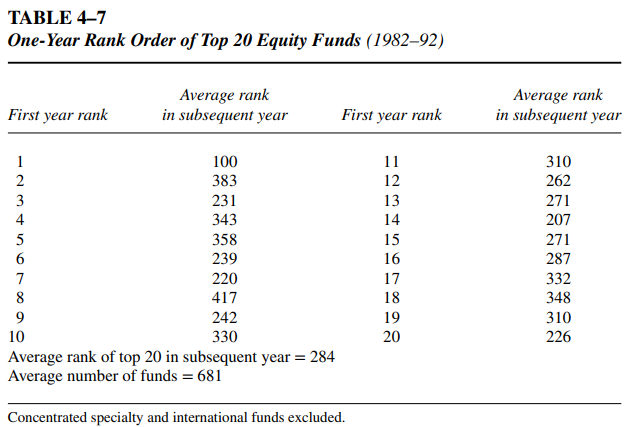

Let’s look at the case study (Taken from book “Bogle on Mutual Funds”) which suggests past fund returns has absolutely no predictive value.

Objective: How did the one-year champions perform during the subsequent year?

Approach: The past records of all the equity mutual funds are checked and top 20 funds are picked in any given year and their performance is measured in future years.

Methodology: To minimize the possibility of randomness in the one-year data, compared fund rankings for each year in the past decade (i.e., where the top 20 mutual fund performers of 1982 ranked in 1983, and so on to where the top 20 of 1991 ranked in 1992). For simplicity, I then averaged the ten periods.

Results:

Interpretations based on 10 year average:

A top 20 fund’s performance in one year has no systematic relationship to its ranking in the subsequent year.

A typical top 20 fund provided a phenomenal return of +42.3% in its leadership year, more than three times the all-fund average of +13.3%. In the second year, its return averaged +17.6%, compared to the all-fund average of +13.1%. It can be described as Regression to the mean which suggests that returns will move towards the long-term average rate of return.

Funds in the top 20 in a given year have, on average, ranked 284 of 681 funds in the subsequent year. While better than mere chance— which would suggest an average rank of 341—it can also be described as regressing to the mean.

The conclusion here is not that you should completely ignore the past performance, but it should not be the only criteria in selecting the mutual fund. Most investors select funds based on the past performance since this evaluation is easier, but it’s a proven fact that this evaluation has no predictive value on future returns.

Investors should first look at fund’s investment objective & strategy and if it aligns with their objective then further analysis should be done on costs, portfolio turnover, concentration of holdings, correlation with benchmark returns, past returns etc.

For understanding what all factors should be considered while selecting a Equity Mutual Fund, refer here. It’s also important to have a long-term investment plan and to avoid making emotional investment decisions based on short-term market fluctuations.

A financial advisor can help you determine the right products based on your investment objective. Feel free to schedule a call with us Consult Us, we will help you create an investment plan best suited for your goals and investment objectives.

Join our community over at Instagram and Facebook