Indian Real Estate Industry

Real Estate is one of the sectors which is globally recognised. There are 4 types of real estate which is present, which are hotel, commercial , residential and retail. The industry is expected to grow at a CAGR of 7.32% from 2019 to 2040 as per the latest report published by IBEF on real estate industry.

Advantages of investing in Real Estate:

1.Diversification:

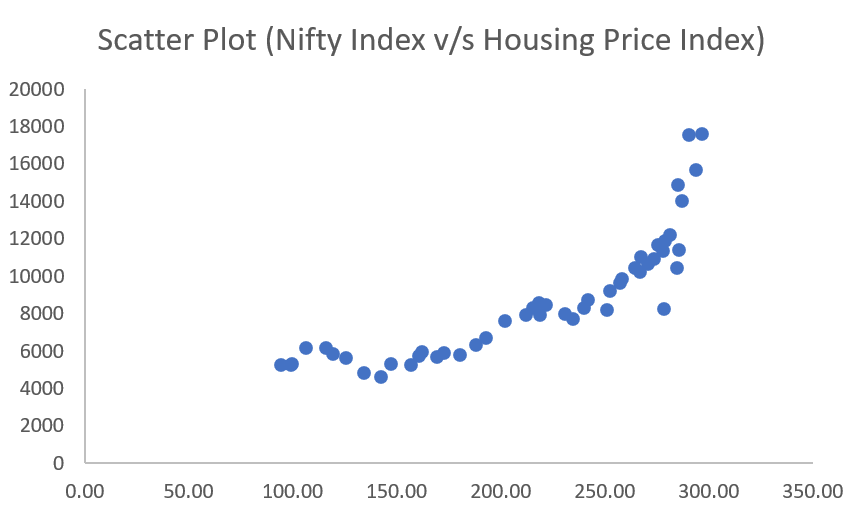

There is a negative correlation between real estate and the stock market. This means that when stocks go up, the real estate market goes down and when stocks go down, the real estate market goes up. This is primarily due to inflation. For example, let’s say that the inflation rate goes up, stocks and bonds prices would come down. This is due to people looking for a safer returns on their investment when inflation rises and people buying bonds and this would increase the prices of the bonds and would reduce the interest rate/yields on the bonds, this would indirectly affect the stock market as the interest rate increases, the investors in the stocks market do not get a good reward for investing in the stock market, they would instead invest in the bond market, hence stocks fall as well. In the case of real estate, the opposite happens. When inflation rises, the rent in the building increases. But this is not true for the prices of real estate, we verified this with RBI’s HPI data we found it had an 84.8% correlation with the stock market. So we get increased rents but we would have to sell the property at a lower price during downturns.

2. Rental Income:

Real estate provides high Rental income at around 6-8% per year for a commercial property in a year, which is higher than FD rate but it is lower than the income from the stock market. But there would also be appreciation of land of around 8% per year on an average in India. This would be higher than stocks which give around 10.34% return (based on NIFTY 50 CAGR calculated from 2009) every year.

3. Tax Benefits:

In India a person gets many tax benefits for purchasing real estate. If you were to buy a residential house property, you would get a benefit of reducing the previous capital gain from stocks, bonds, selling another house, jewelry, or any other asset, under section 54, 54F of the income tax act. If you were to take a loan on purchasing a property, you would also get a deduction for the principal repayment of the loan upto 1.5 Lakh per annum under section 80C on your residential house property. You would also get a 30% standard deduction on the rents every year. You would take advantage of getting a deduction on the interest paid on the loan you take.

4. Long term leverage:

This is one of the most unique proposition in real estate. You can get loans for a period of 15-20 years which you would not get in investment in both stocks, bonds or any other assets. You can get loans upto 90% of the property value that too at 2-3% higher than FD Interest rates. Combined with paying back of EMI through rents, Property appreciation, leverage, you could get about 25-30% returns on your investment if the long term growth rates of the rents and property stick to it’s average.

Considering all these factors, we feel having some exposure into real estate should be considered as an part of one’s investment portfolio.

Disclaimer: Please consult your financial / tax advisor before investment.