We hear about Mutual Funds all the times Be it Index fund, ELSS or Blue-chip fund. Mutual Fund advertisement are on the rise, from watching famous cricketers like Sachin and Dhoni promoting it to worrying about the disclaimer at the end about the risk associated with investing in mutual funds. The question that comes to mind is why are such prominent public figures promoting mutual funds of all things? One can say that there is a lot of money to be made by them from these Ads, while it is true, but the major reason is that the Indian Mutual Fund market is under- penetrated.

HDFC Asset Management Company (AMC) Chairman Mr. Deepak Parekh had this to say during their 23rd Annual General Meeting “Despite a healthy compound annual growth rate of 16 per cent in AUM over the past five years, the MF industry in India remains significantly under-penetrated, compared to global averages.”

He also noted that, despite this growth rate India’s MF AUM-to-GDP ratio is a low 16% against a global average of 74%, Similarly, equity AUM-to-Market Capitalization is at 6% compared to a global average of 33%

This can also be validated by data shared by Association of Mutual Funds in India (AMFI). Which shows out of 43.34 crore PAN holders in India only 3.32 crore have invested in mutual fund, which is a significant increase of 49% against 2.23 crore investors in FY21.

These figures shows that the mutual fund industry is growing and in future many will take some exposure to mutual funds. while having brand ambassadors like Sachin and Dhoni this industry is set help this growth.

So now comes the natural question that if in anyways we are going to make some investment in mutual fund is it possible to save tax while doing so? The answer here comes out to be YES. We can save taxes while investing in mutual fund.

So the next question which comes to mind is which are these mutual funds in which one is able to save taxes? These mutual funds are called Equity Linked Saving Schemes (ELSS) and almost all major Mutual Fund companies offer these. So, you can consider investing in these funds if you are deciding to avail some tax benefits.

These tax saving comes under section 80C of income tax act. Where you can claim a maximum deduction of Rs. 1.5 Lakhs from your total income. Now let us look at all the options available under this section ULIPs, PPFs and ELSS and finally compare them to help you decide which one you should invest in.

ULIP

The Full Form of ULIP is Unit Linked Insurance Plan. It is a market linked insurance scheme where the scheme invests in equity and debt-oriented scheme. So, it is combination of Insurance and market related investments. It provides you a life cover and also lets you reap benefits of stock market or debt fund.

ULIPS forces one to buy Insurance and investment together. As there is no need to lock in a fixed commitment to units of a Mutual fund (clubbed with insurance) with a multi-year time horizon. As If one wants to commit to invest regularly, one can do that by starting a SIP.

The other Major issue with ULIP is the lack of clarity of commission being paid by investor in ULIPs.

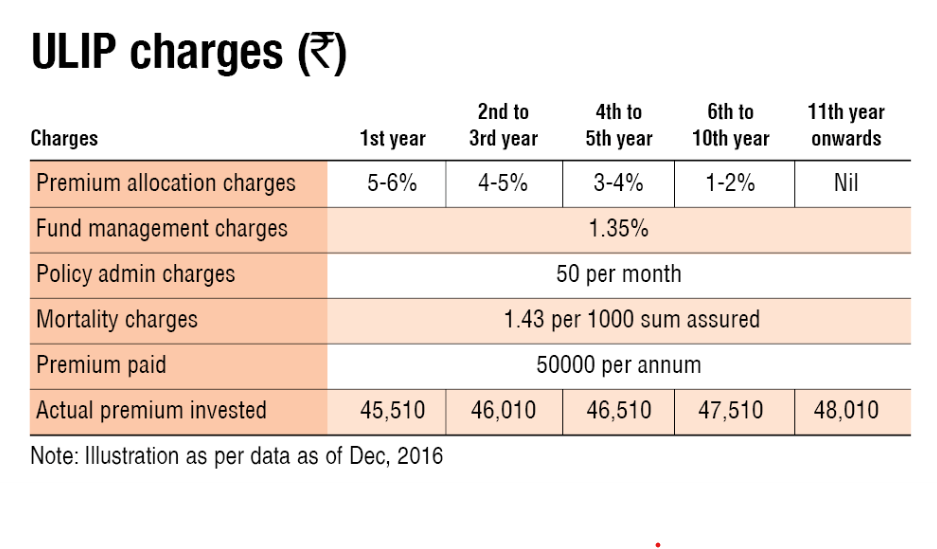

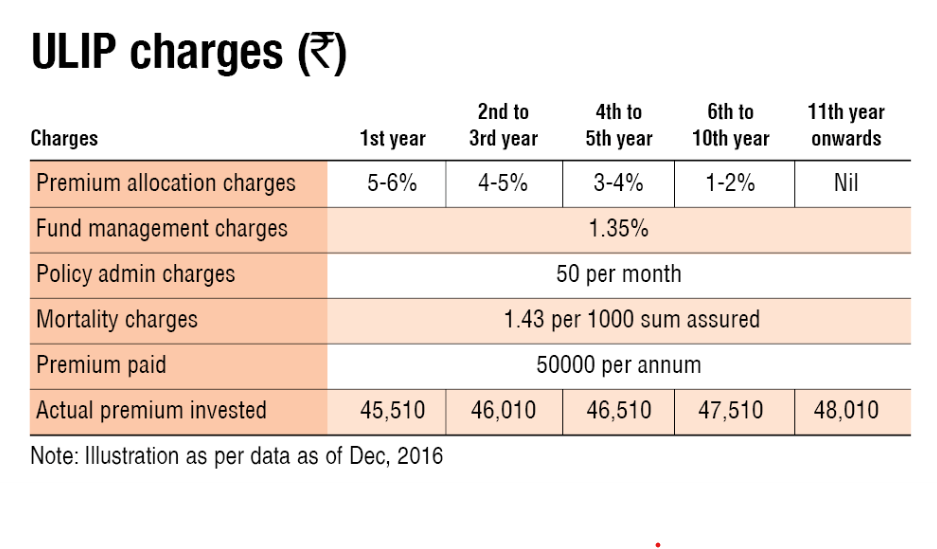

The same can be illustrated through the following chart which enlists a set of charges that are levied by ULIPs. Which are deducted from the premium paid, and actual investment is done after these deductions. These Charges makes almost 7% of the total invested amount. Which is very high commission, even the worst Mutual funds does not charge this much.

PPF

The PPF (Public Provident Fund) account or Public Provident Fund scheme is among the most popular long-term saving-cum-investment products, primarily due to its combination of safety, return and tax saving. It is an Account managed by the government, the major objective of this account is to help individuals make small saving on regular basic and provide returns on this savings. It offers an attractive rate of interest, and no tax is levied on the returns that are generated from the interest rates.

Here is some key information on PPFs

- Tenure: 15 Years (Lock-in Period)

- Interest rate: 7.1%

- Investment Amount: Minimum 500 to Maximum 1.5 Lakhs per annum

So, the major advantage of PPFs is the returned offered here are guaranteed while the major disadvantage is that the lock-in period is 15 years. And you are only getting a return of 7-8% over a period of 15 years. Which might sound good but when we compare it with the average stock market return over similar period, we can see it is not that great.

So, the natural question that comes to mind is why are the returned guaranteed and why are we getting low return of 8% over such long period? The reason is that at the back end PPF funds are invested primarily invested in Central and State government special securities. Which means the funds are used to purchase bonds and thus the returns are risk free.

But the primary issues remain that if you are locking your investment for a period of 15 years, why not invest the same in something like NIFTY 50. The returns here are also almost guaranteed, while it might be the returns are volatile and you might seem to lose money in short term but given a long term view the returns have outperformed PPF, over the past 20 years NIFTY 50 has given a dividend adjusted return of 14.18%. and it is highly improbable that NIFTY will start giving return of 8-9% from 12-14%.

So, from Investment perspective if you have option between PPF and other market instruments like Mutual fund or Index funds, our advice will be that you should go with mutual funds or index funds. Which is better option from a return-on-risk perspective.

ELSS

ELSS or Equity Linked Saving Schemes are Mutual Funds schemes that helps you save taxes. The conditions here is that your money get locked in for a period of three years (Lowest among all options) and are invested in diversified equity and equity-related securities. ELSS funds give you dual advantage of tax saving coupled with higher return by taking advantages of equity markets.

Now let’s do a side-by-side comparison of all the three option to help you decide which investment option is best for you.

| Sl.No | Particulars | ULIPs | PPFs | ELSS |

| 1 | Tax Benefit | Up to Rs.1.5 Lakhs Under section 80C Return from Policy are exempted under section 10 |

Up to Rs.1.5 Lakhs Under section 80C Maturity amount is also exempted from taxation |

Up to Rs.1.5 Lakhs Under section 80C |

| 2 | Lock-in Period | 5 Years | 15 Years | 3 Years |

| 3 | Charges | There are at least five different charges -Premium Allocation charges -Switching Charges -Policy Administration Charges -Mortality Charges -Surrender Charges |

One-time Account Opening charge of INR 100 | Expense ratio in range of 0.5% to 2.5% with very few funds having expense ratio above this |

| 4 | Underlying Assets | Equity, Debt | Fixed Income (Debt) | Equity |

| 5 | Risk (Compared to each other) | Moderate to High-risk category | Risk Free with guaranteed returns as it is government backed | Moderate to High-risk category. |

| 6 | Taxation on returns | Gains are taxable depending on underlying assets | None | Gains above 1 Lakh in give FY is taxable under LTCG |