Summary

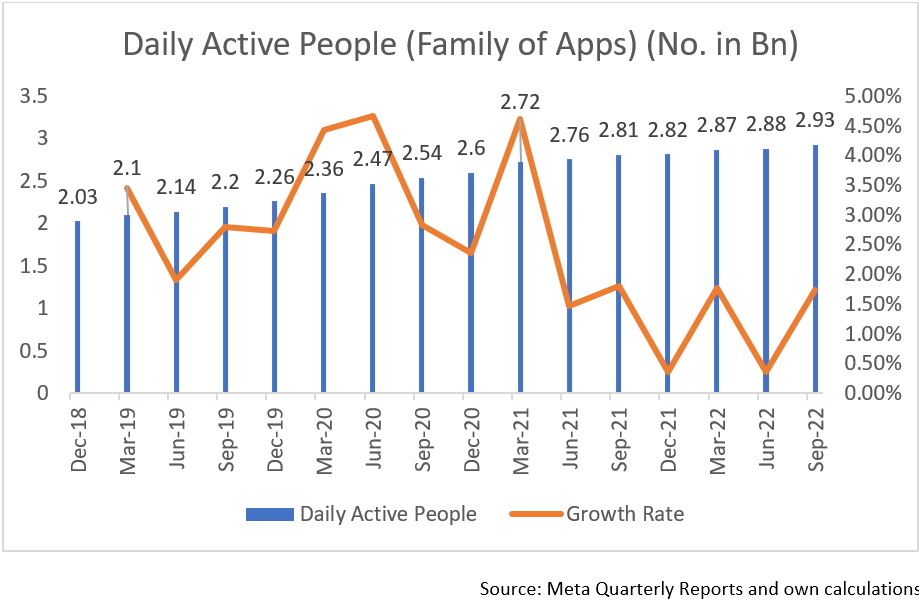

Meta mainly earns revenue from advertising on it’s platforms. The business is saturated with 3 Bn people using it’s apps daily.

Meta’s is a seasonal business with majority of the revenue coming during the December quarter

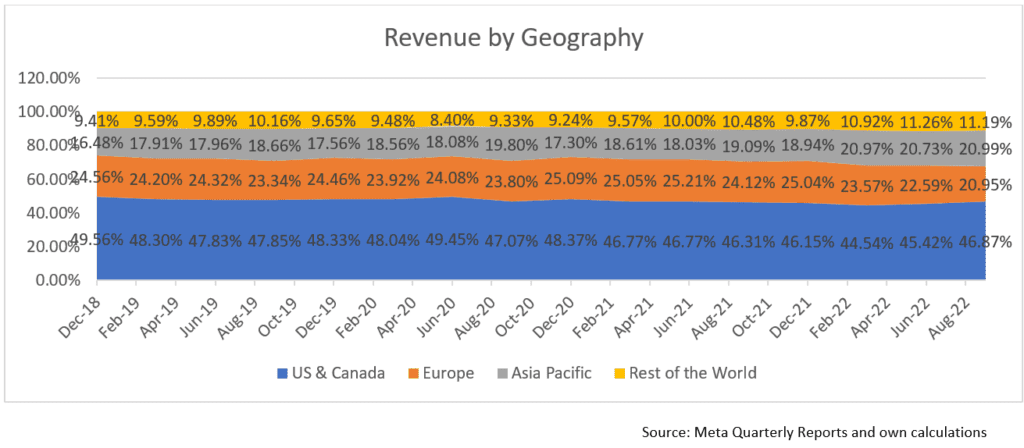

Almost half of meta’s revenue comes from the US, but the percentage contribution is reduced. Asia and rest of the world’s contribution has significantly improved over a period of time, leading to currency risk.

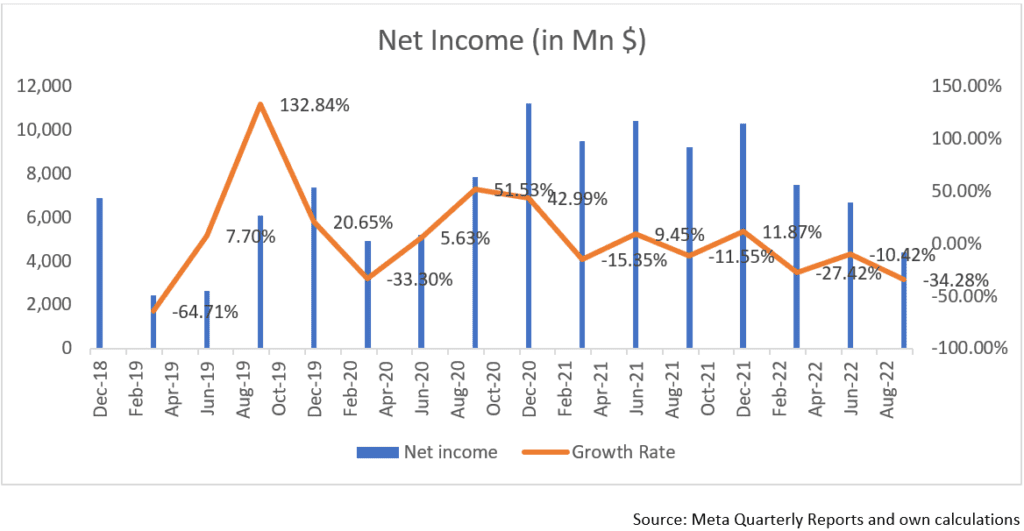

Meta’s net income has declined from 10 Bn in the December 2021 quarter to 4.5 Bn in the September quarter 2022, due to increased spending in R&D and increased spending in selling general & administrative expenses and the revenue declining 3% from the previous quarter.

Mark Zuckerberg the CEO of meta holds 13.12% of the shares but controls 54.167% of the voting power leading other shareholders not being able to stop him from taking any decision, leading to a large risk if people cannot control the expenses on metaverse.

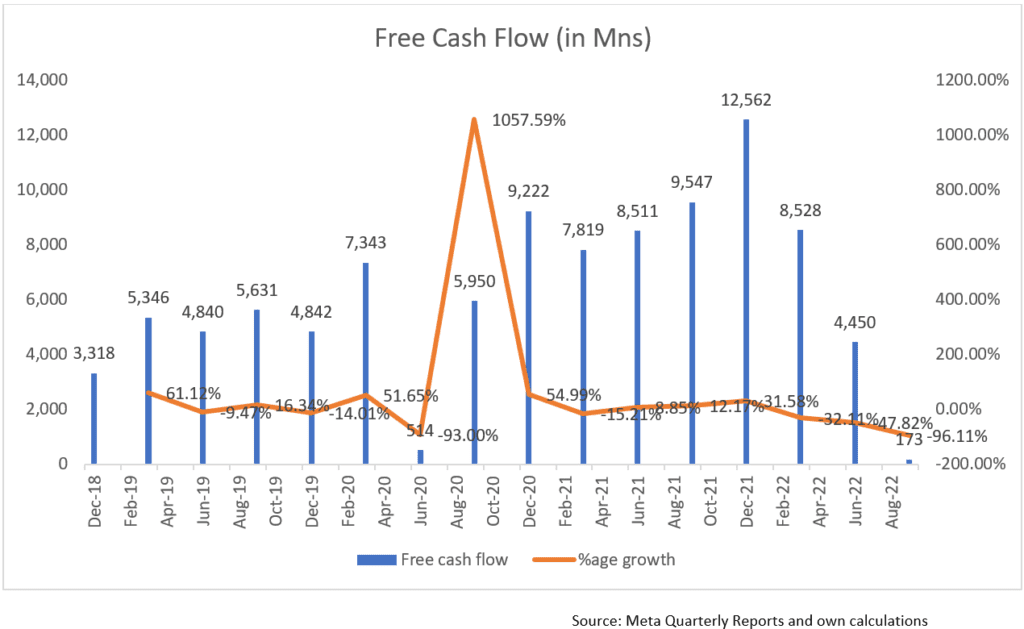

There is huge volatility in the free cash flow metric leading to investors not being able to value the company accurately. There has been a 96% decline in the free cash flow. The last time this happened, it was due to meta paying $5Bn to FTC for violating privacy laws, post which there was a huge increase in free cash flow.

Meta has invested in AI engine which improves the recommendation of AI, reels and ads, which gives improved profitability to their clients as well as improved profitability to Meta which can charge a premium on their ads.

Meta has also invested into data centers as EU has a policy that European data has to be stored in Europe.

There is increased competition from snapchat and TikTok leading to lower screen time for meta, but their quarterly report says that they have increased the number of reels from 93 Bn to 1.4 Bn in 6 months time. This has increased the time spent on meta platforms, which shows that the investment in AI Engine is working.

The company also claimed that there would be a $10Bn hit for the company as Apple changed it’s privacy policy, but we have not seen the revenue decline but we can see that the revenue has not grown.

Meta has spent $36 Bn on metaverse which is still experimental and not earning any revenue. Meta is planning to have capital expenditure of $34-39 Bn in FY 2023 and they have not given the bifurcation of spending on metaverse and for family of apps, which caused investors to be skeptical about the money being spent on something which is experimental.

With both relative valuation and DCF valuation, we think that Facebook is undervalued and offers good margin of safety.

Meta is a social networking company which has two divisions, Family of Apps and Reality Labs.

Family of apps includes Facebook, Whatsapp and Instagram. Their main source of

revenue comes from taking information from people and giving specific ads to

people and charging advertisers for the ads.

Analysis of Family of Apps

We can see that the Daily Active people across the family of apps have been increasing, but at a slower rate than before. Therefore we can conclude that this is a mature company which cannot grow by increasing the number of users in the family of people segment. Now let us look at the revenue that this division is generating.

We can see that the business is a seasonal business with revenue increasing in June and December Quarters with a huge dip in March Quarter. We would see a slight dip in the revenue growth rates in the September quarter but we can now see that in the last two years the revenue has declined in the September quarter. We can understand that the increase in sales in the December quarter is due to Black Friday sales in November and due to Christmas in December. Though the revenue has declined in the September Quarter, it has declined due to other currencies depreciating against the dollar. In the conference call they have said that their revenue actually grew constant currency. Since companies have to report in dollar, they have to convert the currencies in dollar terms at the current rate which is why there is a decline in the revenue. We can also understand where the revenue is coming from so we can better understand the why there is a revenue drop.

We can see that percentage revenue is being generated more in Asia pacific and rest of the world and the contribution of revenue from the US and Europe is declining. Since this is happening, the currency fluctuations would affect the business, contributing to more currency risk.

Coming to the burning topic as to why there is a 75% decline in the share price is because of five major things.

Firstly, it is due to the decrease in net profit over a period.

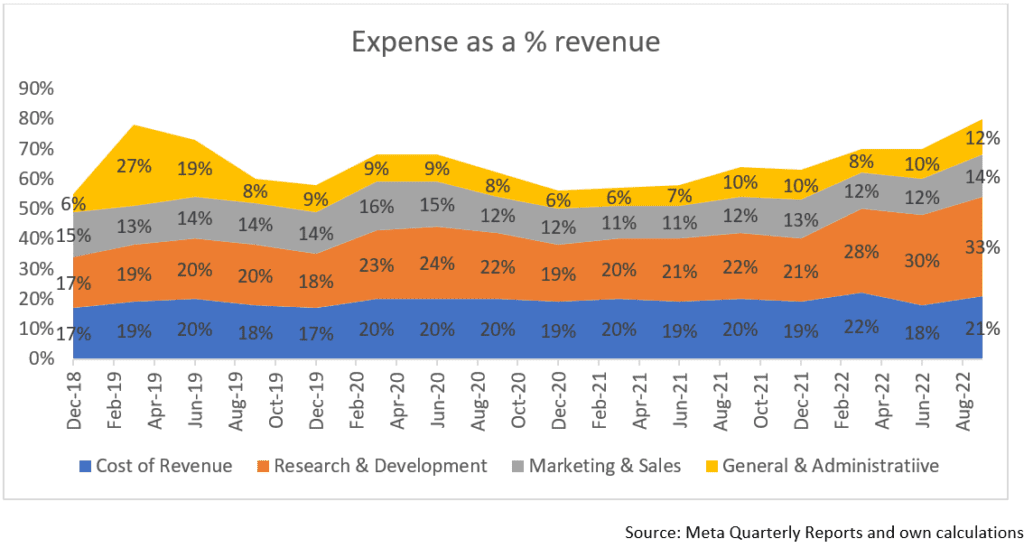

We can see that the net income has been declining due to increased R&D Expense and General & Administrative expenses as a %age of revenue and the revenue itself declining by 3%, which has given a negative growth to the net income of 10.5%. Since this is a time when inflation is at 8.2%, it is highly criticized that the board decided to spend more during this time, especially when analysts think that there is a recession looming.

Secondly, Mark Zuckerberg hold 13.12% of the shares or 347,837,188 as on 31/3/2022, but the shares that he has would be in class B shares which gives him 10 votes per share. This gives him 54.167% of the voting power. There would be no way the investors could change the CEO or that the shareholders cannot take any other decision which might be beneficial for the company as well. They are afraid if metaverse does not work out, he would put the cash in another project which burns more cash. This would be unlike the amazon model where they put in smaller amounts of money into different projects and focusses on the one that succeeds, like the Amazon web services project and they have not gone all in like the metaverse project which Facebook is doing. This is another reason why shareholders want to exit the company.

Thirdly, the most important reason is about the free cash flow decreasing by 96.11%

We can see that the free cash flow which used to be 12.5 Billion in December has dipped to a low of 175 Mn, which is very drastic fall. A company is valued using free cash flow, so if there is huge volatility in this metric, it would be very difficult to value the company. Due to it being very tough, some shareholders would have sold the company’s shares.

| Jun-20 | Sep-22 |

Net cash provided by operating activities | 3,878 | 9,691 |

Less: Purchases of property and equipment, net | 3,255 | 9,355 |

Less: Principal payments on finance leases | 109 | 163 |

Free Cash Flow | 514 | 163 |

Growth | -93.00% | -96.11% |

I have taken the two most important times when meta had a huge dip in their cash flow. The June 2020 quarter was due to paying $5Bn as a penalty to FTC for invading privacy of users in the US. Post this we can see that meta has increased it’s free cash flow substantially.

For the Sep-2022 quarter, we can see that it is due to very high capital expenditure/ purchase of PP&E. So when we look into the quarterly earnings call, we can get to know that the investments are for infrastructure in AI and in data centres. This would improve the recommendations on reels, feed and ads. This would improve the profitability to their clients who have placed ads on their platforms, thereby meta can increase their ad revenue by charging clients more. Meta has spent $36 Bn which is 2021’s profit on metaverse as per your story’s insider analysis, between January 2019 to September 2022. This would come up to 2.5 Bn per quarter or 25% of their cash flow from operations. This investment would be for the long run where if it does find usage, it would improve it’s profitability drastically. They are working on 2 products, one would be for social interactions and other would be for work. They have already got Microsoft Office, Adobe products, Zoom communication, and Accenture. When you plug in the device, you would see three large screens and would be able to get much more productivity in your work. You can refer to Marques Brownlee’s video for more information on the metaverse. Though the results were not bad, the projection of the capex of $34-39 Bn in FY 2023 was what shocked everyone and caused the sharp decline in the stock price.

Fourthly, It is due to European data policy, where European data has to be stored in Europe and meta is contemplating on whether to exit Europe business. In the background they have invested in a lot of data centers is what they have said in the conference call.

Lastly, Meta has got a lot of competition from the likes of snapchat, tiktok which is taking screentime away from meta, which does not reveal how much time is spent on their apps.

Should you buy the meta stock?

“Price is what we pay, Value is what we get” – Warren Buffett. After understanding all the fundamentals one has this question whether to invest in metaverse or not as the stock has fallen down 75% from it’s high. Let us first look at the earnings of meta in the last quarter, it has earned 4.4 Bn, if we assume that the company would earn the same amount for the next 4 quarters. It would be 17.6 Bn. The Market capitalization of Facebook is 256.46 Bn. The PE would be 14.57, the competitor in the ad space is google and has a PE Ratio of 18.14 which shows that there is a lot of room for the company to grow it’s valuation. Using discounted cash flow valuation and keeping in mind all the potential risks that the company has, let us say that the company has a revenue decline in the current year at 0% which is possible as the company has earned $88 Bn in revenue in the first three quarters in the year, the majority of their revenue comes from the December quarter which we have seen above. If we assume that recession hits in 2023 and the company’s revenue declines 15% and then grows at a steady pace of 5% for the next three years and a 2% terminal growth rate which is the long term targeted inflation rate in the US. Factoring in capital expenditure of 33Bn this year which is the highest estimate of meta’s capital expenditure in their conference call and 39Bn the next year. Maintaining all the other margins, working capital, other expenditure the average percentage of revenue it used to be. The valuation of meta per share would be $102.33. This has factored in all the worst possible outcomes that meta could actually have and is still 5.8% higher than what the current price of $96 per share. The company has the potential to grow revenue at 20-40% which has been their last 4 years growth rate, let’s keep all other factors constant, we see that the company would be valued at $144. Post that if the metaverse clicks the company can grow their business at even faster rates which would take the company to even higher valuations. I feel this company is a strong buy, please let us know your thoughts below.