Equity Mutual Funds:

- Based on Market Capitalization

- Large Cap Funds

- Mid Cap

- Small Cap

- Large & Mid Cap

- Multi Cap

- Flexi Cap

There are lot of funds available based on Market Capitalization, they only invest in the stocks which satisfy their Market Cap criteria. Currently the large cap companies are the 1st-100th, mid cap companies are 101st -250th and small cap companies are 251st company onwards in terms of full market capitalisation.

- Tax Saving Mutual Funds: ELSS

These funds primarily invest in equities with options to save tax under section 80C. Each instalment comes with a lock-in period of 3 years which is lowest among other tax saving instruments.

- Value Mutual Funds

Invest in companies which are trading at discount to their intrinsic value. It seeks a combination of growth and income funds, often focusing on stocks with above average yield and below average Price-to-Earnings ratio

- Dividend Yield Mutual Funds

Invest in high dividend-yield stocks with the objective of regular income. This is suitable for people who want regular income from their investments.

- Focused/ Sectoral/ Thematic Mutual Funds

Invests in stocks of single industry like Pharma, healthcare, etc which fund believes can perform better in the coming years. Since they are not diversified across sectors there are more risky than other funds.

- Contra Funds

Invests in stocks which are not performing well, but fund manager believes can perform better in future.

Debt Mutual Funds:

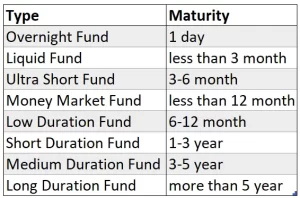

While investing in bond terms, an investor must choose a fund that aligns with investor time horizon. For example, if you are saving for a goal two year ahead investing in Low Duration Fund is advisable and if you are investing for a goal 5 years ahead investing in medium duration fund is advisable. Investor time horizon and bond duration should be aligned to minimize interest rate risk.

- Based on Maturity

- Overnight Fund

- Liquid Fund

- Ultra Short fund

- Money Market Fund

- Low Duration Fund

- Short Duration Fund

- Medium Duration Fund

- Long Duration Fund

With the increase in maturity the rate of return also increases.

- Corporate Bond Fund

These funds invest majorly in corporate bonds with a minimum credit rating of AA+, returns are proportional to the credit rating. High rating translates to low risk, which in turn translates to lower returns. As a general rule, it doesn’t make much sense to invest in low grade bonds in lieu of higher returns.

- Floater

Bonds are also volatile like stocks. As the general interest rate increases the bonds which are available in market issued when the interest rates were lower declines in value hence there is a capital risk. Floater bonds aims to minimize capital risk by investing in floating rate bonds. Here the interest rates are not fixed they go up and down by changing interest rates in economy. It can be beneficial in rising interest rates and not beneficial in decreasing interest rates scenario.

- Banking & PSU

Invests primarily in bonds issued by banks, PSUs. Generally these institutes are backed by government in India, hence they are more secure from credit default.

- Credit Risk

Invests majority in corporate bonds funds with a rating of AA or below. Investor should be aware about taking extra risks in lieu of higher returns.

- Dynamic Bond

As discussed changing interest rates affects the prices of bonds. Dynamic bond funds aim to take advantage of fluctuating interest rates by changing allocation to short-term and long term bonds under rising or falling interest rate environment.

- Gilt

These are nearest to risk free investments that primarily invests in Central or state government bonds. Hence these are less risky, the returns are also lower. Gilt bonds come in different time horizons from short to long terms.

Index Mutual Funds:

This is a form of passive investment, that invests in all the stocks or bonds of an underlying index. They exist to provide broad market exposure with lowest costs and lowest portfolio turnover. We have covered index funds in detail in our previous article.